May 28, 2018

MELBOURE—With enormous local interest in navigating the labyrinth of U.S. taxes from abroad, Democrats Abroad Australia’s Victoria (DAA-VIC) chapter was pleased to host a tax seminar Sunday evening with university lecturer and U.S. tax attorney, Karen Powell. A graduate of Stanford Law School, Ms. Powell has extensive experience in tax matters ranging from federal and state courts to regulatory tax matters, and nowadays exercises her tax expertise in academia.

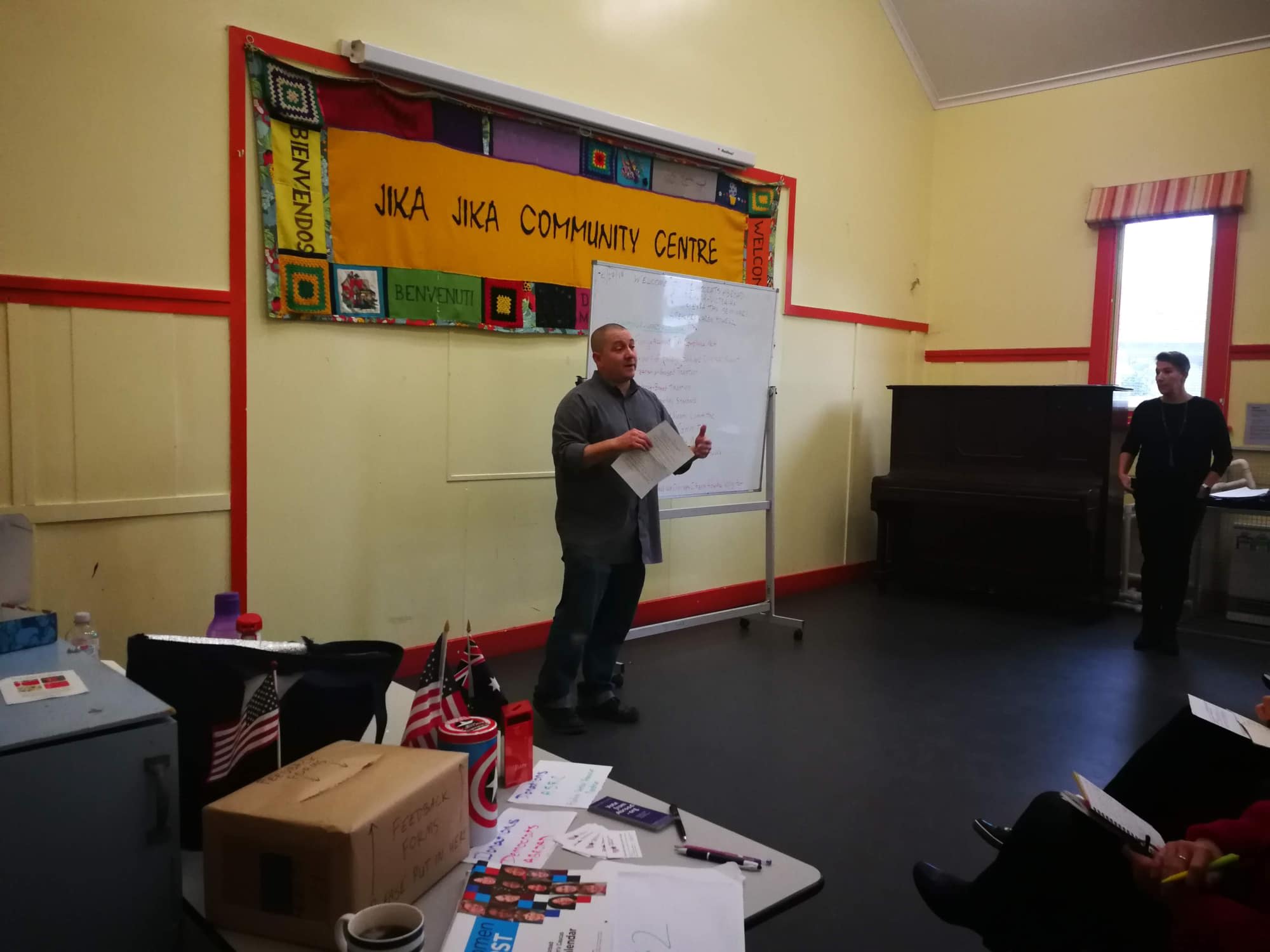

Held at the Jika Jika Community Centre in Northcote, Sunday’s event drew over fifty attendees. Topics covered by Ms. Powell included the basics of understanding taxes, the historical perspective of U.S. taxation, the tax implications of dual U.S.-Australian citizens who file in both countries with the Internal Revenue Service and the Australian Taxation Office, the tax differences on the state level between the U.S. and Australia, the Report of Foreign Bank and Financial Accounts (commonly known as FBAR), the Foreign Account Tax Compliance Act (FATCA), and how individuals should calculate the risks involved in deciding to not comply with U.S. tax obligations.

Many questions were asked by attendees to the evening's key speaker. “The new tax law made sweeping changes to the U.S. tax code – the most significant since 1986,” Powell said. “But for individual expat filings, the overall structure generally remains unchanged. Although every expat should carefully consider their own unique situation, such as determining whether to claim the Foreign Tax Credit versus the Foreign Earned Income Exclusion, it’s probably worth it to seek advice from a tax accounting professional who specializes in expat taxes.”

Ms. Powell also touched on the impact of the updated tax code for American small business owners. In its haste to include Territorial Taxation for Corporations in the Tax Cuts and Jobs Act passed in 2017, Congress created two new “transition taxes” known as the Repatriation Tax and the Global Intangible Low-Tax Income (GILTI) Tax. While the likes of Google and Apple are able to sustain such revenue hits after hoarding billions of profits in overseas subsidiaries, American small business owners abroad are scrambling in fear over how to comply with the new law while surviving financially. Despite extensive lobbying from Democrats Abroad and other pro-expat interest groups, the GOP-led Congress chose to neglect fairer tax reforms for the estimated 9 million Americans living abroad.

Michael Ramos, who also serves on Democrats Abroad’s Taxation Task Force, was present at last night’s seminar. Praising Ms. Powell for her expertise on expat taxation, he offered take-action options for local Americans fed up with the latest changes to the tax code. “If you loved the unfair tax code and job-killing revenue measures for Americans living abroad beforehand, you’ll love the new hand-scribbled tax law passed solely by congressional Republicans. For years, so many overseas Americans have been subject to double-taxation, and many Americans have suffered financial discrimination so badly that they’re seriously considering renouncing their U.S. citizenship, if they haven’t already. To make matters worse, Republicans just hammered the final nail in the coffin for many overseas American business owners with the Repat and GILTI taxes,” Michael stated. “Fortunately, several members of Congress have shown great interest in assisting the Americans overseas community. Whether you’re retired in Melbourne or are doing a temporary study abroad, virtually all Democrats Abroad members want some sort of tax reform, so contacting your U.S. senators and representative demanding action is the best path we can take as their constituents.”

In response to attendees’ questions related to expat tax reform and voting absentee from Australia, DAA-VIC chair, Thomas Lopez, offered his thoughts. “I’m really glad Karen touched on the new tax law and how it hurts American small business owners overseas. Every American abroad who earns income locally should be demanding tax reform from our congressional officials.”

Lopez went on to state, “It all starts with voting. As overseas residents, we aren’t bombarded with TV commercials and daily reminders to vote like we experienced when living in the States. Voting from abroad doesn’t take much effort, and true tax reform that benefits ordinary working Americans – or the 99 percent of us who aren’t millionaires and billionaires – begins by electing Democrats.”

American citizens residing overseas hold a unique view on U.S. taxation. With the expat perspective in mind, Democrats Abroad has taken several actions to inform members of Congress of the unintended consequences of the FATCA, the damage caused by the recently-passed “transition taxes” creation, the urgent need to switch from the current practice of citizenship-based taxation to residence-based taxation, among numerous other tax initiatives.

Following on the success of the last year’s “Resistance Summer” campaign, the Democratic Party has unveiled its new “A Better Deal” campaign to fight the Trump-Republican agenda. The Democratic proposal includes rolling back the enormous GOP tax breaks and special-interest loopholes for the richest one percent, and instead invests that money in America’s teachers and other essential jobs. The current push for tax reform for Americans abroad is consistent with A Better Deal, and Democrats Abroad will continue to fight for a level playing field for tax fairness of U.S. citizens around the globe.

Yesterday’s tax seminar with Ms. Powell coincides with Democrats Abroad’s full representative body passing a resolution in support of abolishing citizenship-based taxation and moving to the more fairer residence-based taxation. The resolution also urges the Democratic National Committee to formally recognize the serious tax issues Americans abroad face, and calls on Congress to take action to rectify the current practice of unfair expat taxation. Although Sunday’s tax seminar was not video-recorded out of respect for privacy requests, DAA-VIC members can still review essential expat tax information from a Democrats Abroad-held webinar from 2017 by clicking here.

To learn more about Democrats Abroad’s tax advocacy efforts, or if you would like to sign up to receive e-mail updates from the DA Taxation Task Force, please click here.

DAA-VIC Vice Chair Marybeth Yarosh contributed to this article.

###

Democrats Abroad is the official arm of the U.S. Democratic Party for Americans residing outside of U.S. states and territories. The Victoria chapter of Democrats Abroad Australia is an active and dedicated group of members whose primary focus is exercising their right to vote from abroad and electing Democratic candidates, in addition to raising awareness of and advocating for issues that concern Americans living abroad.